OilPrice.com online Investigation from 2021.

Note: After information from this investigation was published, in the Globe and Mail and other places, oilprice.com changed the search functions, links and more on his site. However, copies exist of these articles have been preserved by the wayback machine.

https://web.archive.org/web/20210721142330/https://oilprice.com/search/tab/articles/Reconafrica

Oil drillers media partner fabricate analysts in 2020 and 2021

An online investigation into the digital media footprint of Vancouver company ReconAfrica has revealed a pattern of sponsored content and analysis being presented as ‘’news’’. A key player in ReconAfrica’s marketing is the website oilprice.com, edited by James Stafford. OilPrice.com has authored at least 16 articles on ReconAfrica.

A recent National Geographic article reported on a complaint to the SEC from an anonymous whistle-blower which alleges over violations including misrepresenting the stock and false advertising.

It is apparent that Oilprice.com wants investors to be exposed to and the articles signal to investors about the ‘huge upside’. The upside is, according to Oilprice.com, huge because the regime is ‘investor friendly’ and the company will pay very low royalty rates.

The articles stress how it is unusual for a junior company to secure the rights to an area so large. A basin that, in North America would have dozens if not hundreds of companies sharing the action. This differs from the narrative the company presents in Namibia. The articles appear to be news until you get to the bottom, and there is a disclaimer which clearly states that Oilprice.com are shareholders.

A recent article in OilPrice.com is by ‘Ann Gregory’: ‘

’It’s also shocking to find out that ReconAfrica, which has a market cap of only $350 million, owns the rights to the entire 8.5-million-acre basin’’. Texas’s Permian Basin has produced 28.9 billion barrels of oil and 75 trillion cubic feet of gas, with no sign of letting up. As of the time of writing, the Permian basin is producing over 4 million barrels per day’’.

By Ann Gregory – Jan 29, 2021

This is the only article that Ann Gregory has ever written for oilprice.com. Ann Gregory does not show up anywhere else on the internet that we could find, writing about the subject of oil exploration, energy or even stocks. Nor was such a profile found on LinkedIn or other places freelancers congregate.

The next most recent article was authored by ‘Polly Steele’ and hits the same themes. An extraordinary opportunity exists because Namibia gave ReconAfrica the whole basin on incredibly favourable terms. “Offshore, Exxon has scooped up 7 million net acres …Onshore, ReconAfrica is the superstar -and the only player with significant acreage in the field. That’s because it bought up oil and gas rights to the entire Kavango sedimentary basin from Namibia all the way to Botswana before anyone had time to blink.”

By Polly Steele – Jan 21, 2021

Polly Steele, Like Ann Gregory, seems to have no past of being an oil analyst before writing this highly specific article. Indeed, Polly Steele does not seem to exist anywhere else outside of this single article for oilprice.com.

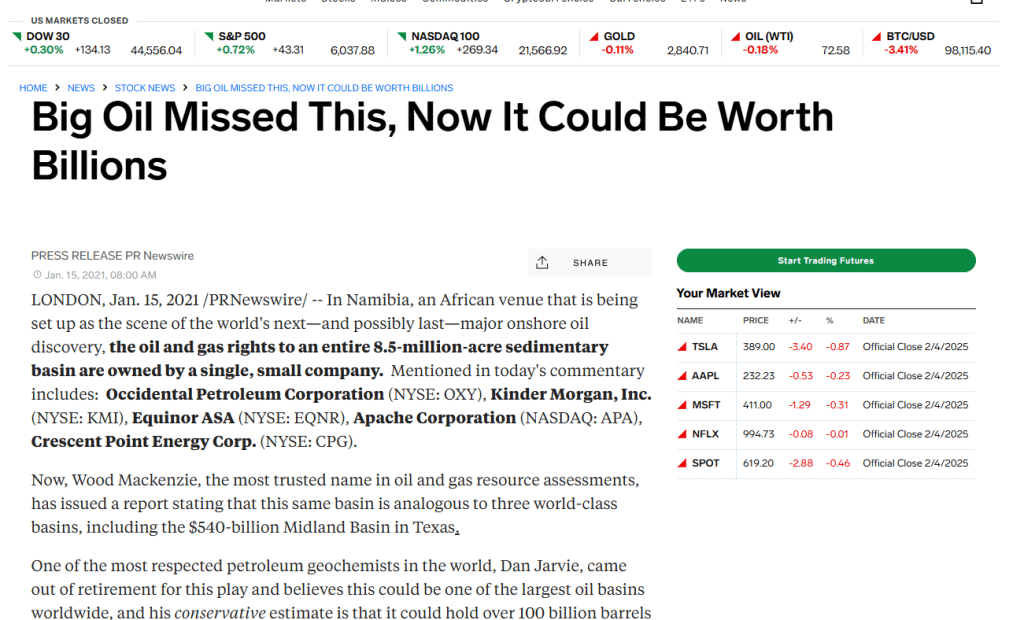

The article previous to ‘Polly Steele’ was released by ‘Cliff Shrew’, ‘Cliff’ wrote the article on 14 January 2021. Cliff hits the same notes as the others who came before and after him.

“In Namibia, an African venue that is being set up as the scene of the world’s next—and possibly last—major onshore oil discovery, the oil and gas rights to an entire 8.5-million-acre sedimentary basin are owned by a single, small company.”

“But onshore, it’s all about ReconAfrica, which strategically swooped in to acquire the rights to the entire Kavango sedimentary basin from Namibia all the way to Botswana.’’ The article appeared in oilprice.com as “Is this the hottest oil play of the decade”.

By Cliff Shrew – Jan 14, 2021 but showed up in other places as “Big Oil Missed This, Now It Could Be Worth Billions”.

This is the only article Cliff Shrew ever wrote for oilprice.com and other than this very detailed, yet very similar article to others on this site, it appears he has authored no other articles on oil or any other subject in his entire life. He does not appear to be a freelancer or employee; he is not on LinkedIn or Facebook. Indeed, it appears as if Cliff Shrew does not exist at all despite his article being shared across numerous websites such Bloomberg, financialnnewsmedia.com streetinsider.com and others.

The next article is by Timothy Mole. Timothy Mole authored this single article for oilprice.com and seems not to have ever written professionally about the subject before or after. Timothy makes the same points, in remarkably similar language as the other analysts.

“Reconnaissance Energy Africa is a small $300+ million company that has secured petroleum licenses for an entire sedimentary basin in Namibia and Botswana…two extremely resource-friendly countries with very low royalties fees.”

‘’Namibia is one of the most exciting up-and-coming African oil venues and that’s precisely why companies like Shell and Exxon have been scooping up assets in the region’’. Timothy Mole wrote on Jan 13, 2021.

The article before that is by Jeff Black only a few days before. Jeff Black has written no other articles on Oilprice.com and seems not to have written about the subject ever before offering this analysis of ReconAfrica.

None of the authors of the ReconAfrica articles appear on the linkedin profile of Oilprice.com where they list their employees.

‘Jeff Black’ also drives home the point about how ReconAfrica have acquired an area usually worked on by numerous producers, not sold to a single junior.

‘’And at 8.75 million acres, that’s nearly the size of the massive Midland Basin in the Permian, which is owned by countless different producers today”.

‘’They scooped up the entire Kavango Basin, giving them exclusive petroleum licenses to a property that’s millions of acres in size”. Jeff Black – Jan 10, 2021.

Article frequency could be interpreted as having an intent to pump the stock rather than inform. Articles came rapidly in January on the 5th,8th, 11th, 13th, 14th and 21st, all using similar talking points and graphics.

Five days prior to Jeff Black’s article we get the most recent article from the editor of the site, James Stafford.

At this point similarities in language are becoming apparent. Readers of the articles see the same language and talking points repeated. The phrase ‘scooped up’ appears throughout the articles. Articles in this vein appeared throughout 2020 on oilprice.com by authors who have no other appearance on the site and use similar language.

‘’Onshore, Reconnaissance Energy Africa has scooped up the entire 6.3-million-acre Kavango Basin’’, Sam Kennedy 24 Aug 2020

A letter from James Stafford to investors also uses that exact phrase:

“I have already scooped up a large position in ReconAfrica” – James Stafford. investor letter A number of the ‘authors’ use the exact same comparison regarding the size of the area ReconAfrica have rights to:

‘’Their land position is now almost the size of Switzerland’’. – Peter Catley December 21

“That’s a basin over 8.5 million acres, almost the size of Switzerland.”- Cliff Shrew 14 January

‘’Earlier this month, Jarvie came out with his own estimates showing the potential for this basin not only almost the size of Switzerland but to be aligned with the Permian in Texas.” Freddie Lambert – Jan 11, 2021

“The newly discovered Kavango Basin, almost the size of Switzerland” – Steve Drew – Dec 16, 2020

An article by James Stafford on January 05 makes the same points as the others, references to the same analogues and references to the one-sided and unusual deal.

(“ReconAfrica”) is a small company that has secured the oil and gas rights to an entire sedimentary basin in Namibia and Botswana – both very friendly to oil exploration, with very low royalty fees (5%) and prospects for discovering an estimated 120 billion barrels of oil (yes, 120 billion).

By James Stafford – Jan 05, 2021,

A November article by Stafford echoes very closely and in similar language all the other alleged analysts on his site, using the same graphics and references, drives home the point again about Namibia’s small royalty fee on such a huge property.

“Reconnaissance Energy Africa is a small company that has secured the oil and gas rights to an entire sedimentary basin in Namibia and Botswana – both very friendly to oil exploration, with very low royalty fees (5%)

By James Stafford” – Nov 18, 2020,

‘Steve Drew’ is slightly more accomplished than the other two authors, Steve Drew apparently authored two articles in 2020. They have the Titles: Two Ways To Win Big On The Oil Price Rebound Sep 23, 2020 and 2 Ways To Win Big On The Oil Price Rebound By Steve Drew – Dec 16.

“Fortunes aren’t only minted through secure investments over the long term. They’re also minted by riskier opportunities that carry huge rewards”, read the lede to his December piece

While back in November his other article that appeared for the site began ‘’Millionaires aren’t only minted through secure investments over the long term. They’re also minted by riskier opportunities that carry huge rewards’’.

Then the articles carry on to make all the familiar talking points and graphics used by almost all of the ‘authors’ of ReconAfrica articles on Stafford’s site.

According to its LinkedIn page oilprice.com is the “most popular energy news site in the world”. Its articles are shared all over the web by other sites that do not seem to do any diligence to the point that they cannot bother to confirm, if the analysts even exist.

“This communication is for entertainment purposes only”;

“This communication should be viewed as a commercial advertisement”

“The owner of [Oilprice] owns shares of this featured company … [and] will be buying and selling shares of this issuer for its own profit.’’

Similar disclaimers were to be found in articles by other analysts on the site.

OIlprice has not only done this for ReconAfrica,

‘’Could This Be One Of The Most Exciting Gold Discoveries Of 2021?’’ appeared on Baystreet.com appeared on the site as ‘’staff reporter’’ but was attributed on Oilprice.com to Kalani Akana, an author who has published no other articles that we could find, ever.

It contains familiar language:

“See, it looks like another savvy small-cap was already on the prowl nearby when Amex made its initial announcement…

In fact, it scooped up an older mine that many of its peers had already written off…’’

Leave a comment